initial consultation.

What To Expect From Your Initial Debt Relief Consultation?

During your in-depth phone debt relief consultation, a Bromwich+Smith Debt Relief Specialist will take a detailed look at your financial situation with you. All debt relief options will be discussed to ensure you have the information you need to make an informed decision on which option is best for your situation. If a Consumer Proposal consultation or Bankruptcy consultation is recommended as your best option and you decide to proceed, an in-office appointment will be scheduled to enable you to sign the documents required to start the process.

What Information Should I Have Ready For Our Initial Debt Relief Consultation?

- Do you have any prior insolvencies?

- Do you have a garnishee or are any creditors threatening you with a garnishee?

- What is the total amount of unsecured debt and what is it comprised of? (ie. credit cards, payday loan, tax debt?)

- Do you own any assets, (eg. house, car, etc.) and what is the value and the balance owing, if any?

- What is your marital status and family size?

- Do you have any Registered Savings plans? (eg. RESP, RRSP, Pensions)?

- Income sources, and amount, if any?

Debt Relief Starts Today

After leading you through a bankruptcy consultation or a consumer proposal consultation, we can get things moving quickly. Once a bankruptcy or consumer proposal is submitted, relief is immediate. Starting right now, all creditor actions must stop. No more collection calls. Garnished wages and active legal actions will come to an end, and any frozen bank accounts are released. You are now on the road to rebuilding your worth. Bromwich+Smith is here to take the journey with you.

Debt Relief Options

At Bromwich+Smith it is our policy to explain all of the debt relief options to you in our initial debt relief consultation to allow you to make an informed decision. We will guide you through each process and explain the pros and cons in detail to you.

Consumer Proposal ConsultationA powerful alternative to bankruptcy, a Consumer Proposal stops all creditor actions and usually requires payment of only a % of original amount owed. No interest. One monthly payment for up to 5 years. Plus, a Consumer Proposal allows you to keep your assets. To learn more about a Consumer Proposal and if a Consumer Proposal Consultation is something you’re interested in, please watch this short and informative video.

|

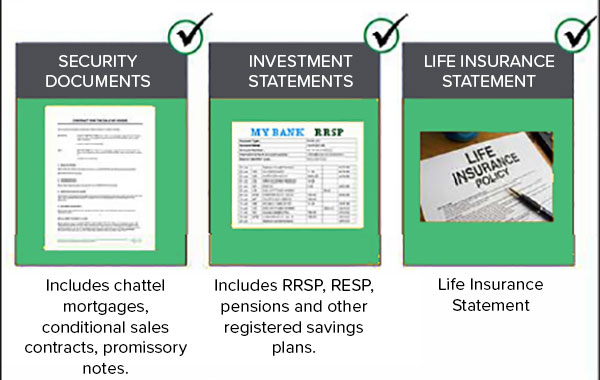

Bankruptcy ConsultationAlthough always the last option after all other options are explored, filing bankruptcy can still be the best option for specific financial situations. There are a number of exemptions available with a bankruptcy as well, allowing you to keep a portion of your home equity, a vehicle up to a certain value, your pensions and other registered savings plans and other exemptions. We'll give you the details in a bankruptcy consultation you need to determine if declaring bankruptcy is best for you. To learn more about bankruptcy or if a bankruptcy consultation is right for you, please watch this short and informative video. |

Do It Yourself - Contact Your CreditorsYou contact your creditors directly, explain your difficulties and ask for some kind of temporary arrangement. Usually most successful when you haven't missed any payments and you have the ability to pay. |

Debt Consolidation Loan from a Bank or Other Financial InstituteAll debts are paid off by the loan provider and you make one monthly payment to that creditor. Requires repayment of debts in full plus interest, and usually requires a good credit rating to qualify and proof of ability to pay. Talk with us in a debt management consultation to see what options you have. |

Orderly Payment of DebtsFederal legislation. |

Debt Management PlanProvincial legislation. |

After Your Initial Consultation, Here Are The Documents You Will Be Asked For To Proceed With Your Debt Relief Program

To retrieve the INFORMATION FORM, please CLICK HERE.

Initial Consultation Documents Index

Initial Consultation Home Page

Information Form - Please fill this form in detail prior to your consultation

A Brief Overview of a Consumer Proposal

A Brief Overview of Bankruptcy

Stay of Proceedings(Section 69) Learn how a Consumer Proposal or Bankruptcy stops all creditor actions immediately.

What Will A Bankruptcy Cost

Property of the Bankrupt - Exempt Assets (Section 67) In Bankruptcy, there are generous exemptions for many types of assets. Find out about your exemptions here.

Duties of the Bankrupt (Section 158) When you declare bankruptcy, there are certain duties that you must perform. Find out about your duties here.

Surplus Income Payment In Bankruptcy (Section 68) If your income exceeds the reasonable standard of living threshold set by the Office of the Superintendent of Bankruptcy, you may be subject to surplus income payments. Learn more here.

Trustee Report (Section 170) If you have been bankrupt before or if you are required to make surplus income payments, a Trustee Report will be required prior to you being discharged from bankruptcy.

Debts or Obligations Not Forgiven (Section 178) There are some debts and obligations that are not included in a bankruptcy or consumer proposal. Learn about these items here.

Co-signed Loans Find out what happens to a co-signed loan in bankruptcy, and the effect on the co-signers.