Documents

Links

Ontario Trillium Benefit

Ontario Trillium Benefit | Ontario.ca

Application for the 2025 Ontario Trillium Benefit and Ontario Senior Homeowners’ Property Tax Grant

Northern Residents Deduction

Education

How taxes are handled during your bankruptcy

Income tax returns

Providing Bromwich+Smith with representative access

Bankruptcy is a legal process under the Bankruptcy and Insolvency Act, by which you may be discharged from most of your debts.

When you declare bankruptcy, a trustee takes control of your property and assets. One of the trustee’s roles is to file income tax returns on your behalf for the year of bankruptcy, along with for the year prior to your bankruptcy (if it has not already been done).

To make sure your tax returns are correct, the trustee uses a tool called CRA’s Represent a Client. This is a secure online system that lets authorized representatives access your tax information.

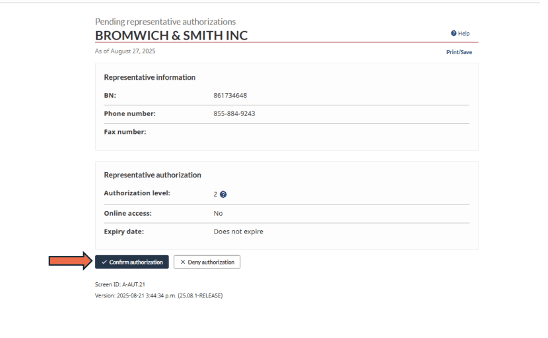

If you file bankruptcy with Bromwich+Smith, you will first get an email saying they have asked for permission to access your CRA account. It’s important to approve this request so their tax team can file your taxes properly.

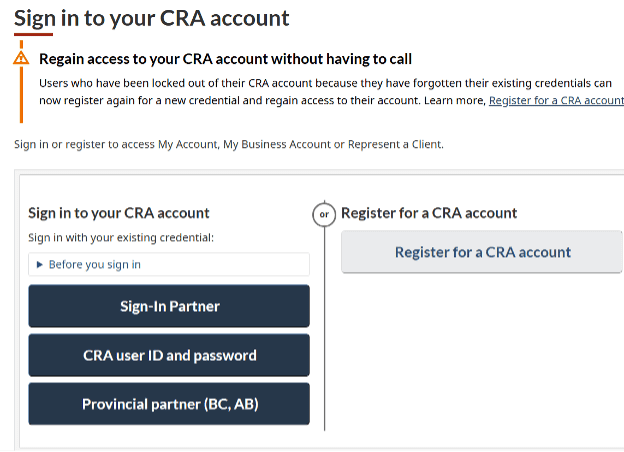

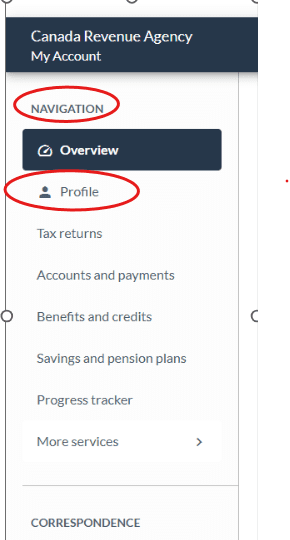

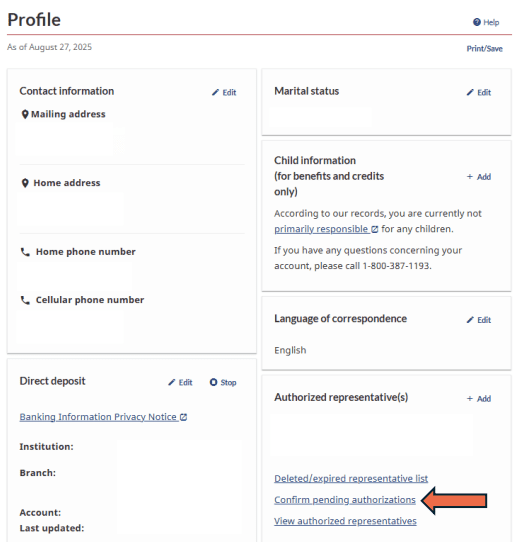

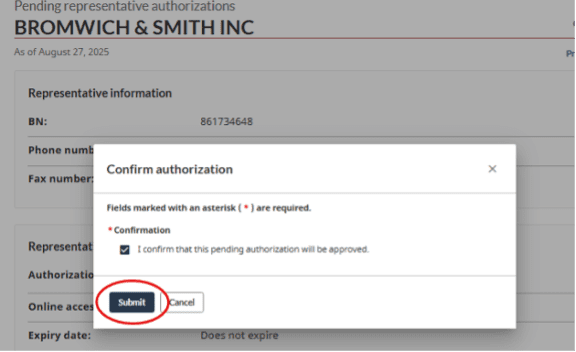

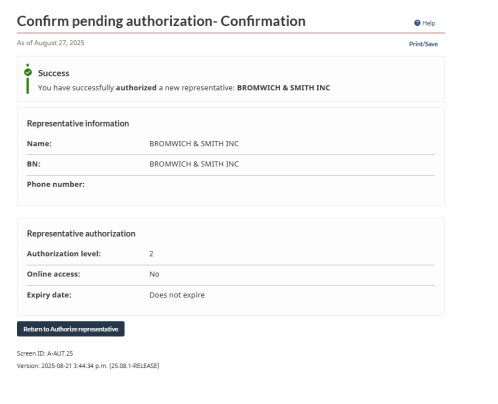

After that, you’ll get another email from the CRA. This email will confirm that a representative (Bromwich+Smith) wants access to your account. You will need to log in to your CRA online account and approve the request.

Here’s how to do it:

We’re here to help

Get in touch

Managing debt can be difficult, but we’re here to help. Our debt relief specialists can show you your options and help you choose the best plan for you.

![Green calendar icon]() Book a consultation

Book a consultation

Leave us your information and one of our specialists will reach out to you.