Why a consumer proposal could be right for you

Bromwich+Smith team

21 Jan, 2025

Financial challenges can be overwhelming and leave you feeling confused and alone. The word bankruptcy tends to bring up feelings of shame and embarrassment. If you’re hoping to resolve your debt without resorting to filing for bankruptcy, then a consumer proposal might be the solution you’re looking for. This debt relief option is designed to help Canadians resolve financial struggles while protecting their assets.

What is a consumer proposal in Canada?

A consumer proposal is a formal, legally binding process under Canada’s Bankruptcy and Insolvency Act (BIA). It’s an alternative to bankruptcy for individuals with unsecured debts of up to $250,000 (excluding a mortgage on your primary residence). A consumer proposal can only be administered by a Licensed Insolvency Trustee (LIT) and must be approved by the majority of your creditors.

- Debt reduction: Your LIT will help put together a debt repayment plan based on what you can afford. This will condense your debt payments into a monthly payment over the course of up to five years

- Creditor approval: The plan is shared with your creditors who must accept the proposal before you start paying. While this can feel intimidating rest assured that your trustee is there to propose the plan to your creditors on your behalf. They will have 45 days to vote on the proposal. Your proposal is approved if the majority of your creditors accept the proposal

- Stay of proceedings: This will offer you legal protection against any creditor actions including lawsuits or wage garnishments and will freeze any interest or late payment charges from growing your debt

Unlike bankruptcy, a consumer proposal lets you keep your assets while making manageable payments to resolve your debts.

Signs a consumer proposal may be right for you

Recognizing when it’s time to consider a debt relief program like a consumer proposal is key to getting back on track to financial independence.

- Unmanageable debt: If you’re overwhelmed by unsecured debts including credit cards, personal loans, or payday loans

- Struggling to make minimum payments: Making only the minimum payments on your debts but seeing no reduction in balances is a sign your debt is not manageable long term

- Calls from creditors: If phone calls and letters from your creditors or collection agencies are constant, a debt relief program like a consumer proposal will put a stop to these

- Protect assets and avoid bankruptcy: You are looking for a solution that allows you to keep your car, assets and the equity in your home

- Fixed income or budget: For those on a limited income, a structured repayment plan can make debt repayment more manageable

Steps to file a consumer proposal in Canada

If you’ve decided a consumer proposal might be the right choice but want to know what you should expect, here’s what you should know.

- Meet with a Licensed Insolvency Trustee (LIT)

- Start by reaching out to a Licensed Insolvency Trustee, the only regulated professionals who can file consumer proposals. During this free consultation, the LIT will review your financial situation, explain your options, and recommend whether a consumer proposal is a good fit for you. This meeting may take place in person, on the phone or virtually

- Evaluate your financial situation

- Your trustee will review your income, expenses, assets; and debts to create a reasonable proposal that balances your needs and what creditors are likely to accept. They’ll start by asking questions about your lifestyle, current financial situation and employment. Don’t worry though, they won’t share any of your personal information with your employer. Trustees simply use this information to determine your ability to make monthly payments for the duration of the consumer proposal. It’s important to answer all questions honestly as this will help your LIT to create a realistic budget and repayment plan- there is no judgment

- Create the proposal

- The proposal outlines how much you’ll repay, over what period; and any other terms. Most proposals offer to repay a portion of the debt in affordable monthly payments. The trustee will need to balance what you can afford to pay and what your creditors will accept

- File the proposal

- Once finalized, your trustee will file the proposal with the Office of the Superintendent of Bankruptcy (OSB). This will stop creditor actions, including wage garnishments, lawsuits; and collection calls

- Creditor review and voting

- Your creditors have 45 days to review and vote on the proposal. If the majority of creditors vote in favor, all of the creditors must follow the terms of the agreement. If the majority of creditors reject the proposal, your trustee will ask you if you want to offer a new payment amount or explore other options

- Begin payments

- Once fully accepted, you will begin making the agreed-upon payments to your trustee who distributes the funds to creditors.

- Attend financial counselling

- You’ll attend two mandatory financial counselling sessions to learn about budgeting, managing money; and how to avoid future debt problems

- Completion and debt discharge

- Once you fulfill the terms of your proposal, your remaining unsecured debts will be legally discharged

Pros and cons of a consumer proposal

A consumer proposal offers many benefits, but it’s not the right solution for everyone.

Pros of a consumer proposal

- Avoid bankruptcy: A consumer proposal allows you to reduce your debt without filing for bankruptcy

- Debt reduction: Typically, you’ll only repay a portion of the debt owed and not the full amount

- Asset protection: You will not be required to surrender assets such as your home or car to pay for the debt owed

- Legal protection: Filing a consumer proposal stops collection calls, lawsuits; and wage garnishments

- Fixed payments: Monthly payments are tailored to your budget and offer you a set date for when your debt will be fully resolved

- No interest: Payments are interest-free and the interest on your debt will not grow over the proposal period

- Credit recovery: While it will have an impact on your credit, a consumer proposal is less severe than bankruptcy and may lead to quicker financial recovery. If you’re already missing payments your credit is taking a hit and having a plan in place will stop additional hits to your credit score

Cons of a consumer proposal

- Credit impact: A consumer proposal remains on your credit report for 3 years after completion or 6 years from the filing date, whichever comes first

- Creditor approval needed: Creditors will vote to accept the proposal. While most are willing to negotiate, there’s no guarantee. When you have your initial consultation with your trustee, consider asking what their creditor approval rate is. This will give you an indication of how likely your file is to be accepted on the first offer

- Not all debts are included: Secured debts (like mortgages or car loans) and specific unsecured debts (like child support or court fines) are not included in a consumer proposal filing. Student loan debt can only be included if the debt is older than seven years

- Longer commitment: Payments can stretch over five years, requiring long-term effort whereas a first-time bankruptcy filing is typically only nine months

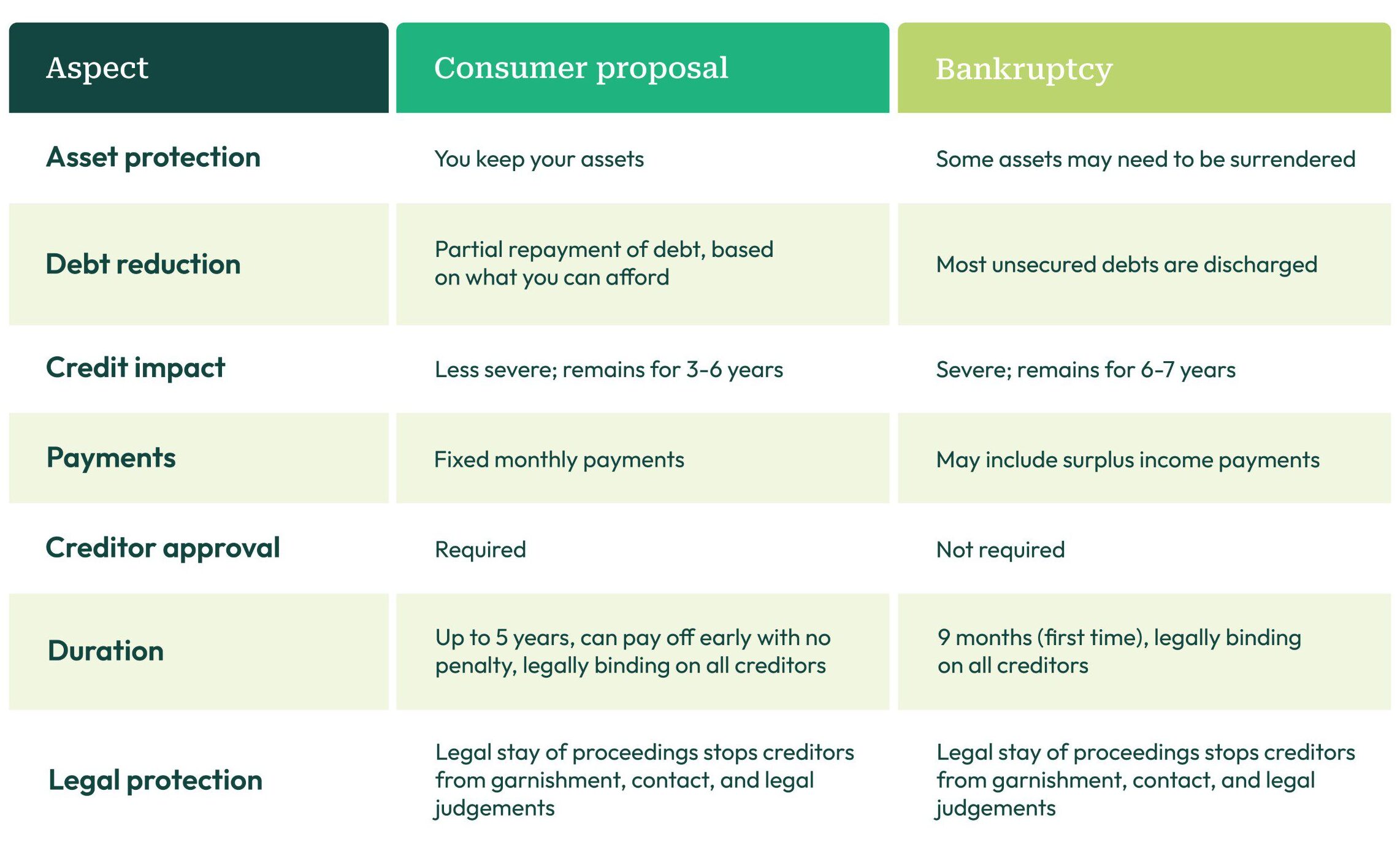

Consumer proposal vs. bankruptcy

Life after a consumer proposal

Completing a consumer proposal provides a clean slate, but rebuilding your finances takes time and effort. It’s not easy- but it’s worth it.

- Establish a budget: Create a budget that prioritizes savings, essential expenses; and responsible spending. If your situation changes (job loss, change to income or housing situation) update your budget to reflect these changes

- Rebuild credit: Consider applying for a small, secured credit card and making on-time payments to strengthen your credit score

- Monitor your credit report: Regularly review your credit report to ensure accuracy and track progress

- Avoid future debt: Use the financial skills learned during counselling to stay on track

- Save for emergencies: Building an emergency savings account will help protect you against future financial setbacks

Is a consumer proposal right for you?

Deciding whether to file a consumer proposal will depend on your unique circumstances, there is no cookie-cutter solution that will work for everyone. Remember, there’s no shame in talking about debt and seeking help. Taking the first step—whether through a consultation with an LIT or simply learning more about what your options are is a solid move towards a brighter future.