debt solutions demystified

Dealing With Debt? There Are Options!

Finding a solution to take control of debt can be stressful. The good news is, there are always options to explore. Depending on the financial situation, debt counselling and budgeting might be the best options. In other situations, the legal protection of a Consumer Proposal or Bankruptcy may be the right solution to eliminate debt and start rebuilding worth today.

While both a Consumer Proposal and Bankruptcy offer federally legislated and legally binding solutions to restructure debt, there are significant differences in how each solution works. In this section, we'll explore what you should know about options:

- How it is determined which option is best, depending on the financial situation.

- The legal protection from creditors that both solutions offer.

- The sequence and timing of events before and after a proposal or bankruptcy is filed.

Consumer Proposal. What Is It and How Does It Work? (Video)

A Consumer Proposal can be a powerful alternative to bankruptcy. With a Proposal, all creditor actions are stopped, and the amount owed is reduced to an amount based on what budget allows. This usually results in debt being reduced to only a percentage of original amount owed. There are no interest charges, and a Consumer Proposal allows up to 5 years to pay. Plus, a Consumer Proposal doesn't touch assets.

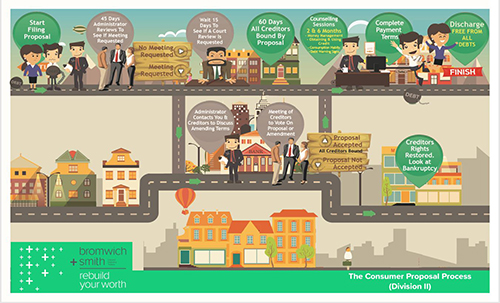

Consumer Proposal - The Process from Filing to Discharge

Bankruptcy. What Is It and How Does It Work? (Video)

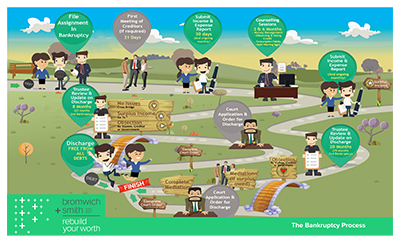

Before recommending bankruptcy, all other options are explored. However, in some financial situations, bankruptcy can be the best solution to stop legal actions and permanently eliminate debt. Bankruptcy can provide the fresh start needed to get back on track to rebuilding worth.